Grok AI Analysis: A Chance for HKD-USD Peg Delinking After Hong Kong’s Foreign Adversary Listing

Image Credit: Joseph Chan | Splash

On February 21, 2025, U.S. President Donald Trump signed the “America First Investment Policy” memorandum, a directive that marks a significant escalation in the United States’ stance toward Hong Kong by listing it among “foreign adversaries” alongside China, Macau, Cuba, Iran, North Korea, Russia and Venezuela. This move, which empowers the Committee on Foreign Investment in the United States (CFIUS) to impose stringent investment restrictions, signals a deepening hostility that could reshape Hong Kong’s financial landscape.

[Read More: Hong Kong’s AI Development: Opportunities and Challenges Amid Geopolitical Shifts]

The Memorandum: Defining Hong Kong as a Hostile Entity

The “America First Investment Policy” explicitly identifies Hong Kong, a Special Administrative Region (SAR) of China, as part of a broader group of foreign adversaries, a classification that aligns it with nations under heavy U.S. sanctions. President Trump underscored that “economic security is directly related to national security”, citing concerns that investments from these regions—particularly China and its SARs—into U.S. technology, critical infrastructure, healthcare, agriculture, energy and raw materials could undermine American interests. The memorandum accuses China of leveraging U.S. capital to bolster its military and intelligence capabilities, a charge that now extends to Hong Kong by association.

Background: Hong Kong’s Financial Status and the USD Peg

Hong Kong has long been a linchpin in global finance, renowned for its robust markets and strategic position as a gateway between East and West. Central to its economic stability is the HKD’s peg to the USD, established in 1983 under a currency board system. This peg, maintained at approximately 7.8 HKD per USD, is backed by substantial foreign exchange reserves—currently exceeding US$400 billion—managed by the Hong Kong Monetary Authority (HKMA). The system has weathered crises like the 1997 Asian Financial Crisis and the 2008 Global Financial meltdown, earning a reputation for resilience.

However, the United States, under President Donald Trump, implemented significant policy changes toward Hong Kong on July 14, 2020, by enacting the Hong Kong Autonomy Act and issuing Executive Order 13936. These measures escalated U.S.-China tensions and introduced new uncertainties for Hong Kong. The Hong Kong Autonomy Act mandates sanctions against individuals and entities undermining Hong Kong's autonomy, while Executive Order 13936 declares a national emergency concerning Hong Kong, leading to the suspension of its preferential treatment under U.S. law. These actions, including the revocation of Hong Kong's special trade status, aim to penalize the city for aligning with Beijing's policies, notably the 2020 National Security Law. Analysts have speculated that such measures could pressure the Hong Kong dollar's peg to the U.S. dollar, a cornerstone of the city's financial framework.

Our Methodology: Engaging Grok 3 for In-Depth Analysis

To unpack the financial implications of President Trump’s hostility listing, we utilized two distinct features of xAI’s Grok 3. Initially, we activated the ‘DeepSearch’ function, posing the question: “What is likely to happen to Hong Kong from the financial point of view in the next 10 years now that the US has recently listed it as a hostile entity?” This prompted Grok 3 to scour extensive datasets, including economic reports, real-time market data, and geopolitical developments, to construct a comprehensive outlook. Building on this foundation, we then employed the ‘Think’ feature, asking: “Can you estimate the probability of the HKD-USD 7.8 peg being delinked based on this information?” This step directed the AI to apply a probabilistic framework, synthesizing the earlier findings into a precise likelihood estimate. This dual approach ensured a thorough and data-driven analysis tailored to our viewers’ need for clarity on this complex issue.

[Read More: Can AI Help in Court Ruling? A Study in a Hong Kong Case]

Grok 3 DeekSearch’s Response (1/10)

Grok 3 DeekSearch’s Response (2/6)

Grok 3 DeekSearch’s Response (3/6)

Grok 3 DeekSearch’s Response (4/6)

Grok 3 DeekSearch’s Response (5/6)

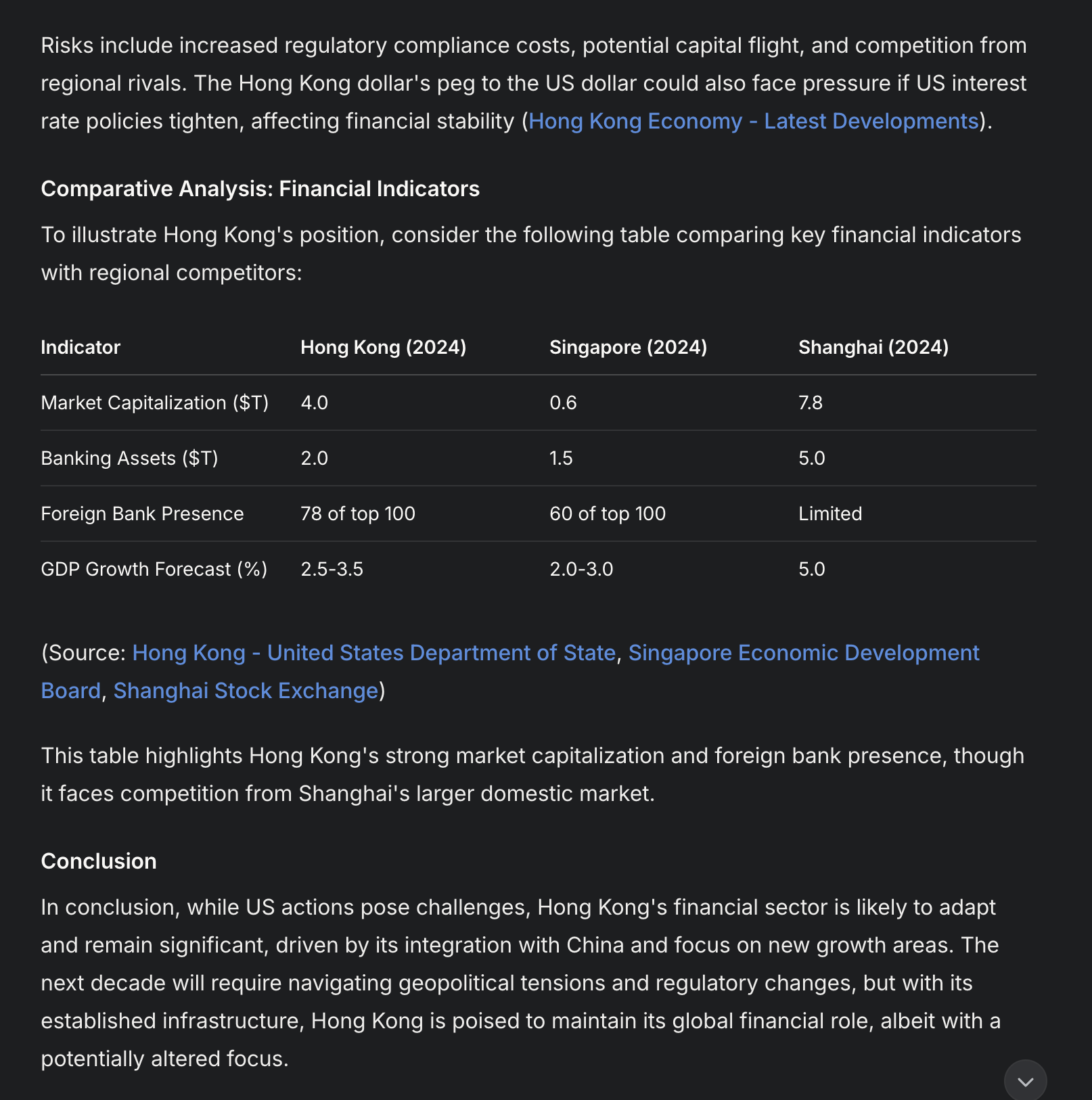

Grok 3 DeekSearch’s Response (6/6)

Grok 3’s Analytical Approach: AI at the Forefront

Grok 3 ‘DeekSearch’ uses extensive datasets and real-time information to analyze complex scenarios. It relies on algorithms to assess historical trends, current economic data, and geopolitical factors. For this analysis, it reviewed Hong Kong’s foreign exchange reserves, GDP growth estimates (2.5% in 2024, with additional growth projected for 2025), banking sector conditions, and the effects of U.S. sanctions. It also considered risks like capital outflows and China’s potential responses, such as increased financial ties with Hong Kong.

The AI ‘Think’ employs a probabilistic approach, assigning numerical likelihoods to possible outcomes rather than fixed predictions. This method allows Grok 3 to address the uncertainties of geopolitical developments, providing a detailed perspective that has drawn interest from financial analysts and policymakers.

[Read More: IKEA's AI Vision and Smart Light Dilemma: Innovation Meets Roadblocks in Hong Kong]

Grok 3 Think’s Response (1/4)

(Fact check: The reserves are approximately five times, not seven times, the currency in circulation. The total currency in circulation includes Certificates of Indebtedness (CIs), which back the banknotes issued by note-issuing banks, and government-issued currency notes and coins.

As of the latest data:

- Certificates of Indebtedness: HK$603.01 billion

- Government-issued Currency Notes and Coins: HK$13.30 billion

Total Currency in Circulation: HK$616.31 billion.)

Grok 3 Think’s Response (2/4)

Grok 3 Think’s Response (3/4)

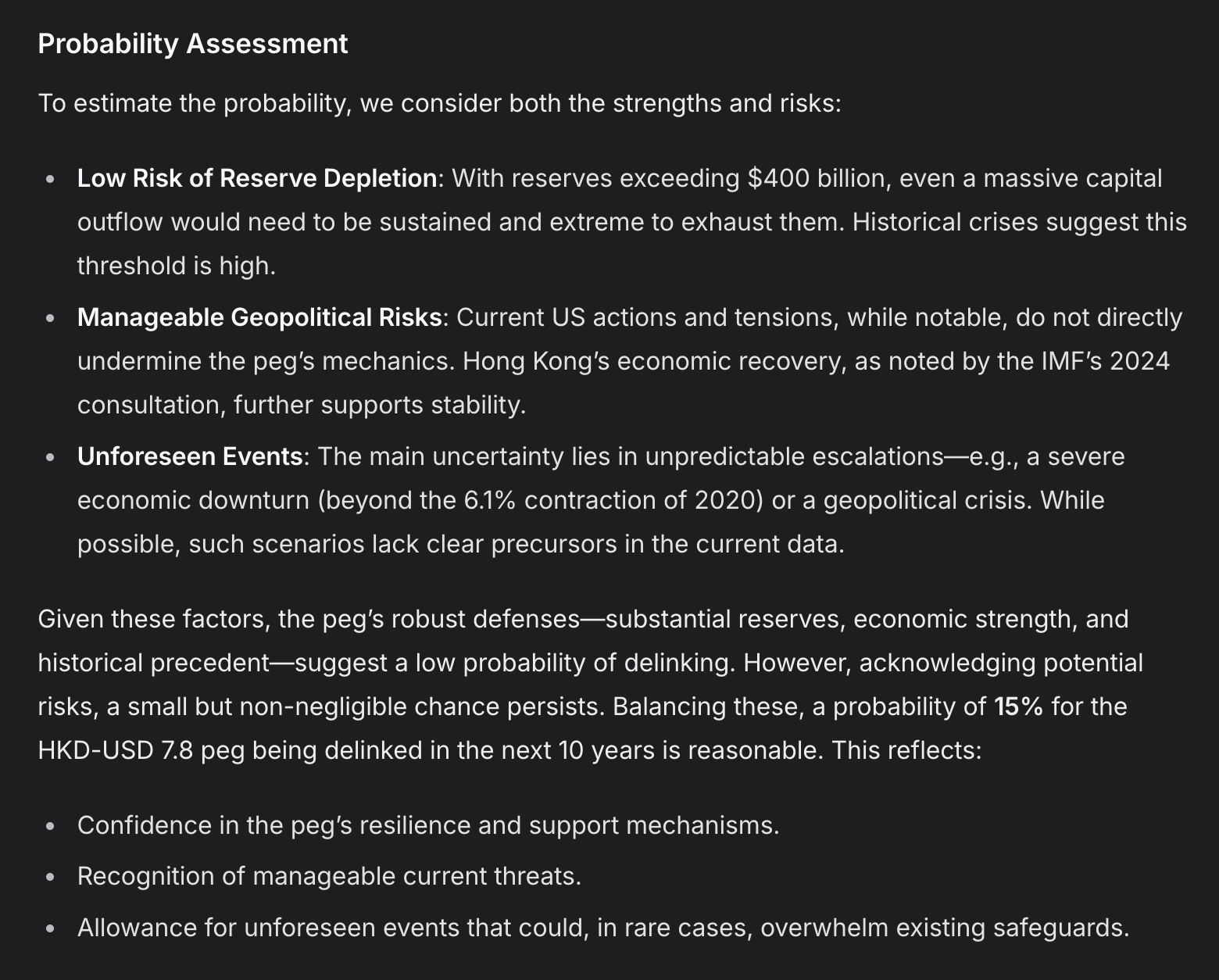

Key Finding: 15% Probability of Peg Delinking

Grok 3’s headline result estimates a 15% probability that the HKD-USD peg at 7.8 will be delinked within the next decade. This figure reflects a careful balance between stabilizing factors and emerging risks. The AI highlights the HKMA’s $421 billion in reserves (as of the end of January 2025) as a formidable defense against speculative attacks or capital outflows triggered by U.S. hostility. It also notes Hong Kong’s economic recovery, with the financial sector contributing 21.3% to GDP, reinforcing the peg’s stability.

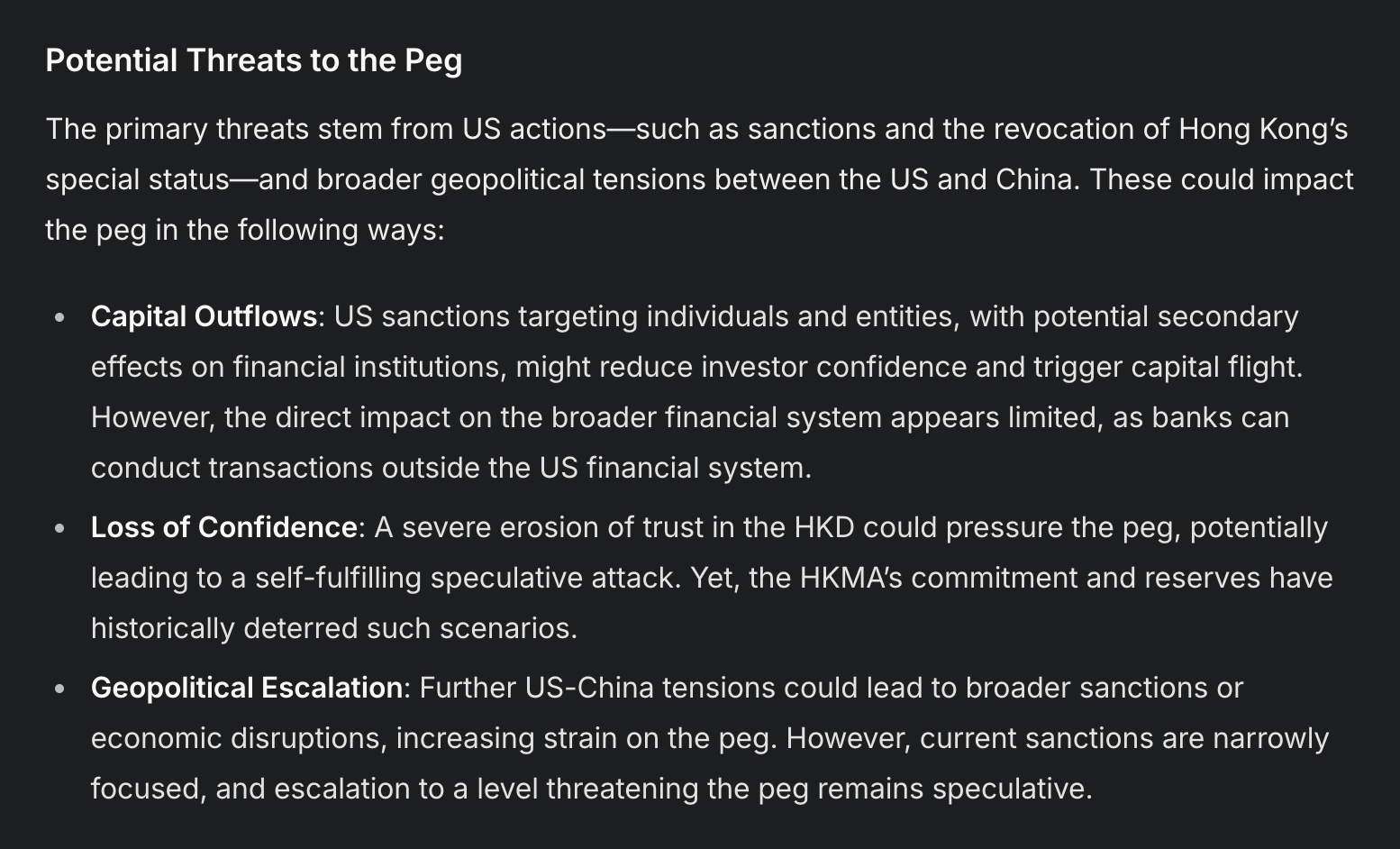

Yet, the 15% probability acknowledges potential vulnerabilities. U.S. sanctions could deter American investment, which has already dropped by US$1 billion since 2020, potentially spurring broader capital flight. Grok 3 models a scenario where sustained outflows, coupled with heightened geopolitical tensions, could strain reserves. However, the AI deems this unlikely without a dramatic escalation, such as barring Hong Kong banks from the SWIFT system—a step considered extreme by experts.

[Read More: Hong Kong Police to Deploy AI-Enhanced Drones Amid Broader Plans for Low-Altitude Economy]

Grok 3 Think’s Response (4/4)

Financial Implications: Beyond the Peg

Beyond the peg’s fate, Grok 3 forecasts broader financial impacts from Trump’s hostility listing. It predicts increased compliance costs for Hong Kong’s 78 top-tier global banks, many of which may need to reroute transactions to avoid U.S. penalties. The AI suggests this could dampen banking sector profitability, though it notes banks’ adaptability—such as conducting deals outside U.S. jurisdiction—may mitigate losses.

Hong Kong’s stock market, with a US$4 trillion capitalization, faces potential volatility, according to Grok 3. Reduced U.S. investment might shift capital flows toward China or other Asian markets, though initiatives like the Greater Bay Area integration could offset this by attracting mainland funds. The AI also flags opportunities in green finance and fintech, areas where Hong Kong is expanding, as potential stabilizers.

[Read More: AI Scams Target Hong Kong Legislators with Deepfake Images and Voice Phishing Tactics]

Comparative Context: AI vs. Traditional Analysis

Grok 3’s 15% estimate contrasts with some human-led forecasts.

Analysts at DBS Bank have expressed confidence in the sustainability of the HKD-USD peg. They argue that the peg remains both viable and desirable, citing Hong Kong's ample foreign reserves and the peg's role in maintaining monetary stability. Their analysis suggests that the USD/HKD peg is likely to remain stable within its policy-prescribed range in the foreseeable future.

Conversely, U.S. lawmakers, including Representative John Moolenaar, Chairman of the House Select Committee on the Chinese Communist Party (CCP), have raised concerns about Hong Kong's financial system. In a letter to Treasury Secretary Janet Yellen, Moolenaar and Ranking Member Raja Krishnamoorthi highlighted issues such as Hong Kong's alleged role in facilitating money laundering and sanctions evasion involving countries like Russia and North Korea. They requested a briefing on potential actions the U.S. might take in response to these concerns.

[Read More: Hong Kong Launches $3 Billion AI Funding Initiative to Boost Innovation and Research]

Critiques and Limitations: AI Under Scrutiny

While Grok 3’s analysis is compelling, it’s not without scrutiny. Critics question whether its 15% figure underweights black-swan events—like a sudden U.S.-China trade war escalation—that could defy historical patterns. The AI’s reliance on public data, including X posts and web sources, also raises concerns about bias, especially given recent controversies over Grok 3’s handling of politically sensitive topics. xAI has addressed such issues, with engineering lead Igor Babuschkin affirming efforts to refine the model’s neutrality.

Additionally, Grok 3 does not disclose the computational cost of its analysis, a metric some experts argue is crucial for assessing efficiency. Despite these caveats, its transparency in revealing system prompts and reasoning steps bolsters its credibility for a news audience seeking clarity.

Conclusion: AI as a Financial Crystal Ball?

As Donald Trump’s signature reshapes U.S.-Hong Kong relations, Grok 3 emerges as a vital tool for decoding the financial fallout. Its 15% probability of a USD-HKD peg delink suggests stability is likely but not guaranteed, offering a measured take amid heated debate. For Hong Kong, the stakes are high—preserving its financial hub status may hinge on navigating U.S. hostility and leveraging China’s support.

[Read More: False Credentials in Elite Education: A Closer Look at the HKU Scandal and the Role of AI in Preventing Fraud]

Source: Inside Asian Gaming, Wikipedia, SCMP, Reuters, HKMA, International Trade Administration, HKEX, US Government, Business Insider, The Register